Transforming human systems is the defining challenge of our time. It requires us to consider the bigger picture, seeing the forest for the trees and addressing the root causes of problems as opposed to their symptoms.

One of the most effective mechanisms for achieving such a shift is systemic finance. And indeed, embedded at the core of systemic finance are two key concepts for implementation: leverage points and strategic investment portfolios.

But what exactly are these tools, why do we need them, and how can investors best utilise them? We were joined by Ivana Gazibara and Andre Ticoulat of TransCap for our third Regenerative Investment Roundtable to explore.

What are leverage points?

Certain interventions in a system have greater potential than others to ignite deep-rooted change.

When investors have thoroughly analysed a system to identify its deep-rooted, interconnected relationships, it becomes clear where the most promising opportunities for intervention lie. In other words, it shines a light on the system’s leverage points — the most fertile ground for transformative impact.

Leverage points are engaging nodes where a relatively small action can trigger a large, systemic effect. As Ivana puts it, “they’re places within a complex system where a small shift in one thing can produce big changes in everything else”.

In the real world: Financing the regenerative transition in the Midwest

TransCap, along with a consortium of other partners, are currently exploring the capital requirements for enabling the transition to regenerative agriculture in the Midwest.

Systems mapping and leverage point identification will enable TransCap to develop an intervention strategy, the basis for building a pipeline of financeable interventions and structuring funding vehicles.

Identifying leverage points

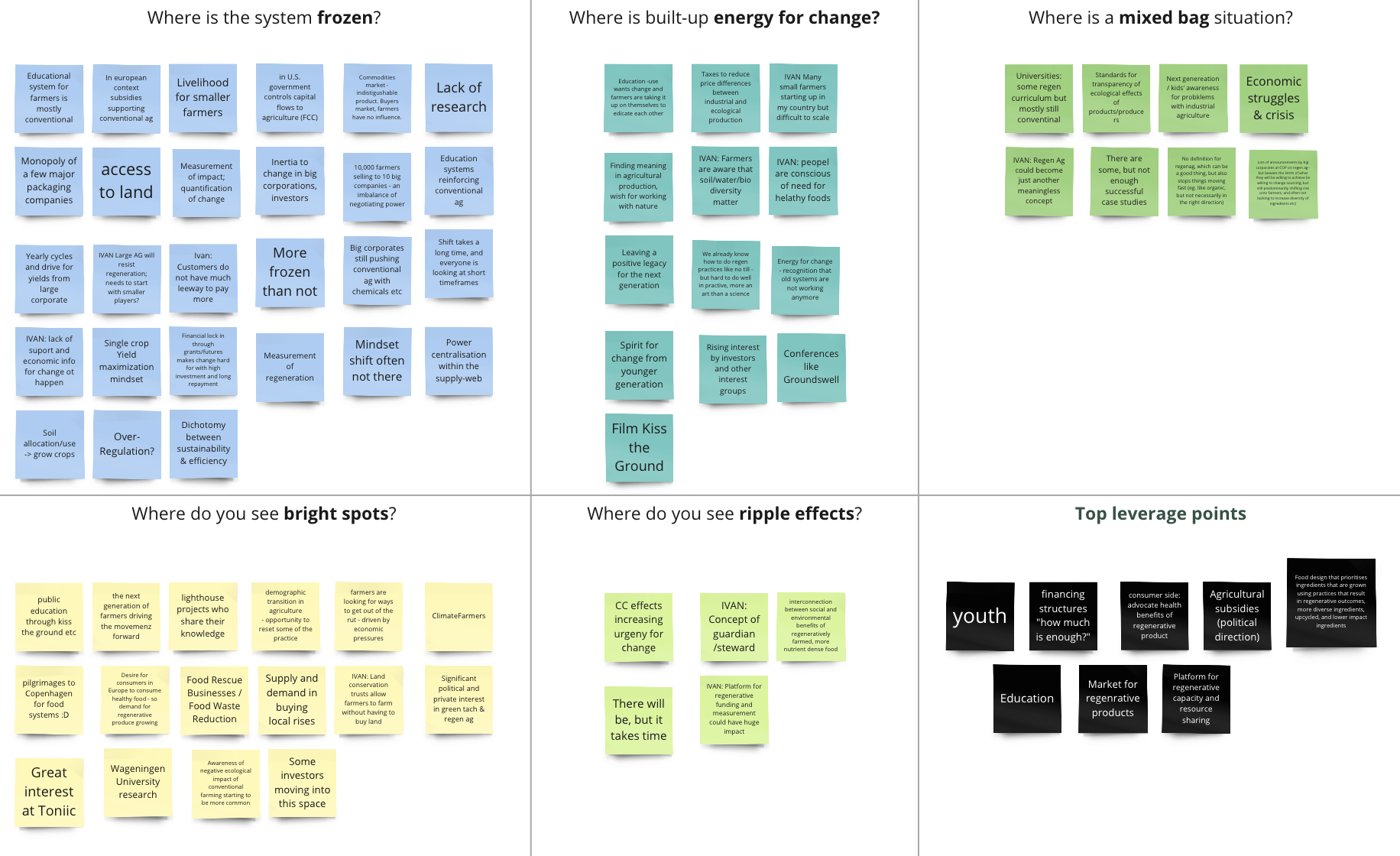

Building on Ivana’s inspiring case study, we turned our attention to identifying leverage points for scaling regenerative agriculture in Europe.

As part of the workshop, we discussed: Where the system is frozen, where there is built up energy that has the potential to disrupt the status quo, where there is a mixed bag situation, where positive change is already occurring, and where lies potential ripple effects.

From agricultural subsidies to consumer awareness and financing mechanisms, participants identified countless potential leverage points entwined in the system.

From leverage points to a strategic investment portfolio

Systemic transformation is rarely a result of individual endeavours. Rather, it evolves through the combined influence of numerous types of interconnected interventions taking place with a degree of strategic coherence.

Crucially, levers of change often have varying capital needs. This is where strategic investment portfolios come in.

A strategic investment portfolio is designed in alignment with non-financial, complementary interventions. This is the process of nesting.

All interventions are selected so as to be mutually reinforcing, resulting in the sum of a portfolio being greater than its parts.

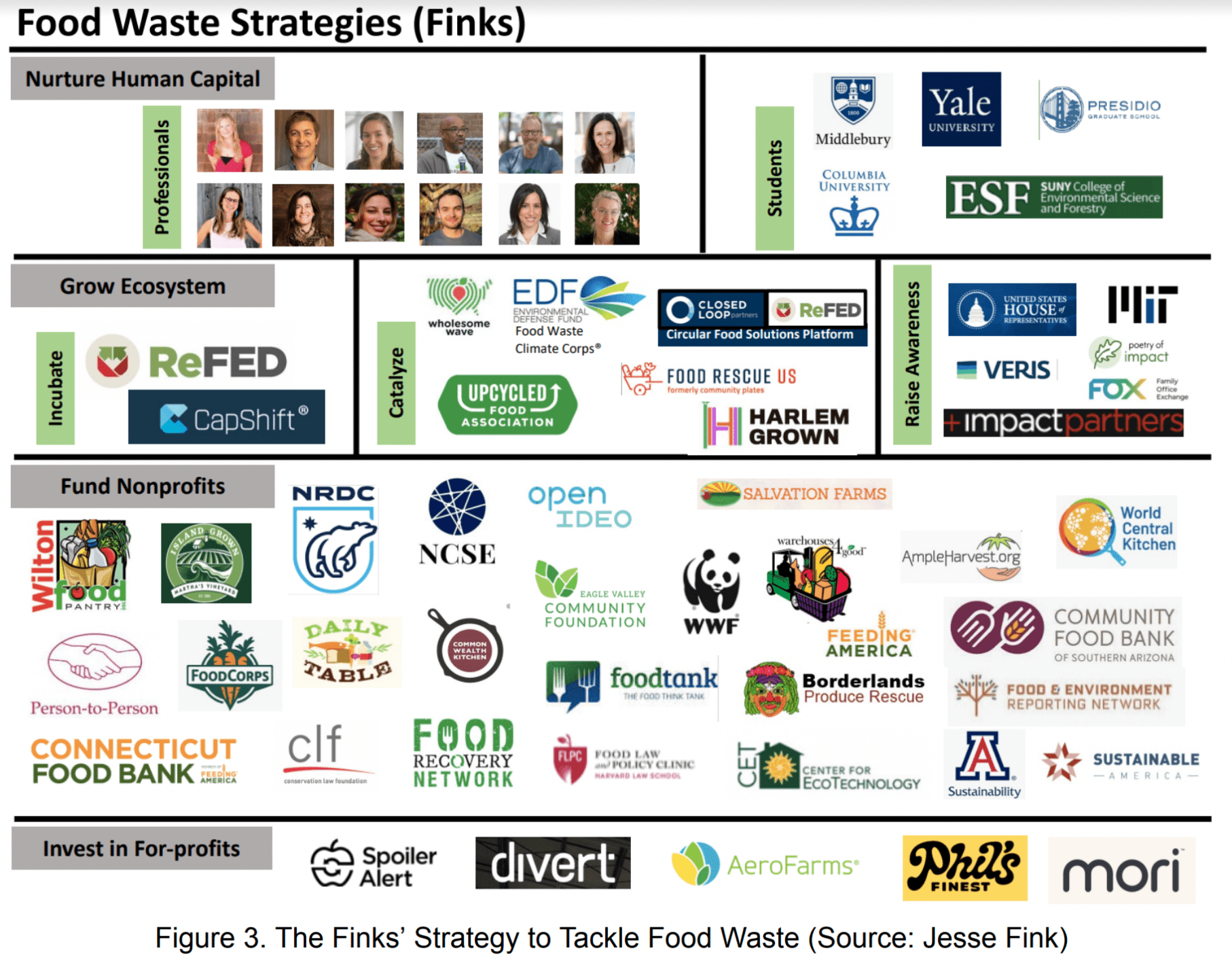

Some philanthropic endeavours have a successful track record of strategically aligning with investment capital. One example includes the Fink Foundation’s efforts to redesign food waste in the United States.

Building on the Fink Foundation’s approach, we asked roundtable participants to use a leverage point they identified in the previous exercise and brainstorm how different types of interventions might activate it.

“It’s about a ton of people doing a ton of things in a coordinated way. This varies from community work, infrastructure work, supporting farmers on the ground as lighthouse projects. If we can find the right actors, we can get things moving. If there are investors who can coordinate such a portfolio, then the chance of actually having a transformative effect will be more achievable.”

– Roundtable participant

Closing remarks

There is a lot of work that needs to be done to spark real systems transformation.

It’s clear that the strategic use of capital has the power to shape our world and reorient it towards regeneration as opposed to extraction. Now, we need to channel that potential and put it into practice.

If you’re an investor, inheritor, or wealth manager interested in being part of that change, register your interest in joining our monthly Regenerative Investment Roundtable discussions.